The Monetary Policy Committee (MPC) has several plausible reasons for adopting this steady approach.

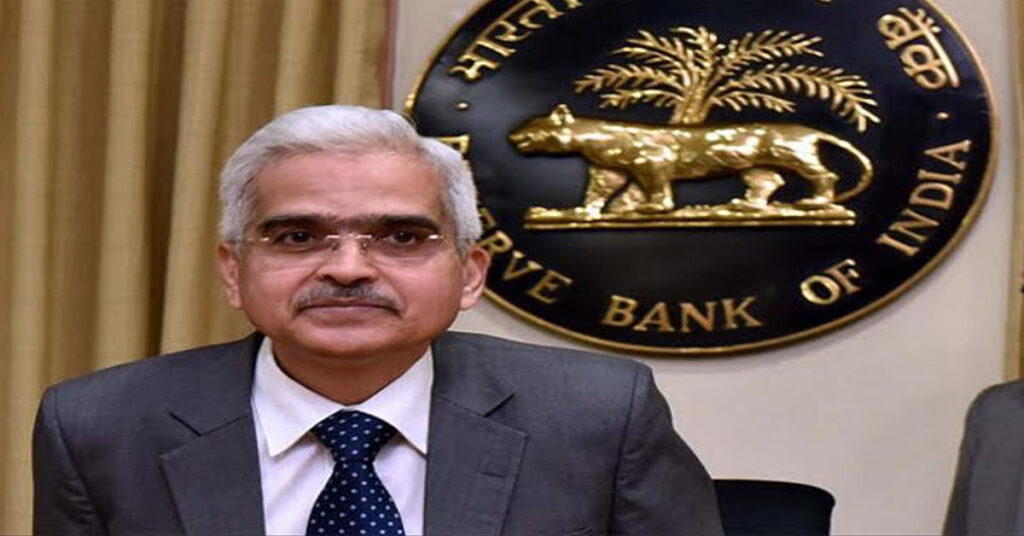

RBI policy: Why is Monetary Policy Committee likely to leave repo rate unchanged?- The Reserve Bank of India (RBI) is poised to maintain its status quo on the repo rate, largely thanks to the intricate dynamics of current economic conditions. The Monetary Policy Committee (MPC) has several plausible reasons for adopting this steady approach.

Primarily, inflation metrics have shown signs of moderation. While retail inflation soared beyond the RBI’s comfort zone earlier this year, recent data indicates a noticeable decline. This deceleration in inflation is partly attributed to easing supply chain bottlenecks and stabilizing commodity prices. By holding the repo rate unchanged, the RBI aims to consolidate these gains and ensure inflation remains within the targeted band of 2-6%.

Secondly, economic recovery, although on a steady path, remains fragile. The Indian economy has been showing recovery signs post-pandemic, albeit unevenly across sectors. Manufacturing and services are gaining pace, but consumer sentiment and spending have not fully recovered to pre-pandemic levels. A hike in interest rates might stifle this fledgling recovery by dampening consumption and investment.

Thirdly, a global economic outlook fraught with uncertainties also necessitates a cautious stance. International financial markets are navigating through volatility, influenced by geopolitical tensions and policy shifts in major economies like the United States and China. An abrupt alteration in the repo rate could lead to capital outflows or exchange rate volatility, potentially destabilizing the Indian financial system.

Lastly, the RBI might be adopting a wait-and-watch approach. With global central banks exhibiting varied policy trajectories, the RBI may prefer to observe the international monetary landscape before making any significant changes. Ensuring monetary stability while fostering growth remains its top priority.

CONCLUSION

In conclusion, the RBI’s decision to likely keep the repo rate unchanged is a strategic blend of fostering economic stability, supporting recovery, and navigating global uncertainties. By maintaining this balanced approach, the MPC aims to steer the Indian economy through the prevailing complexities with caution and foresight.